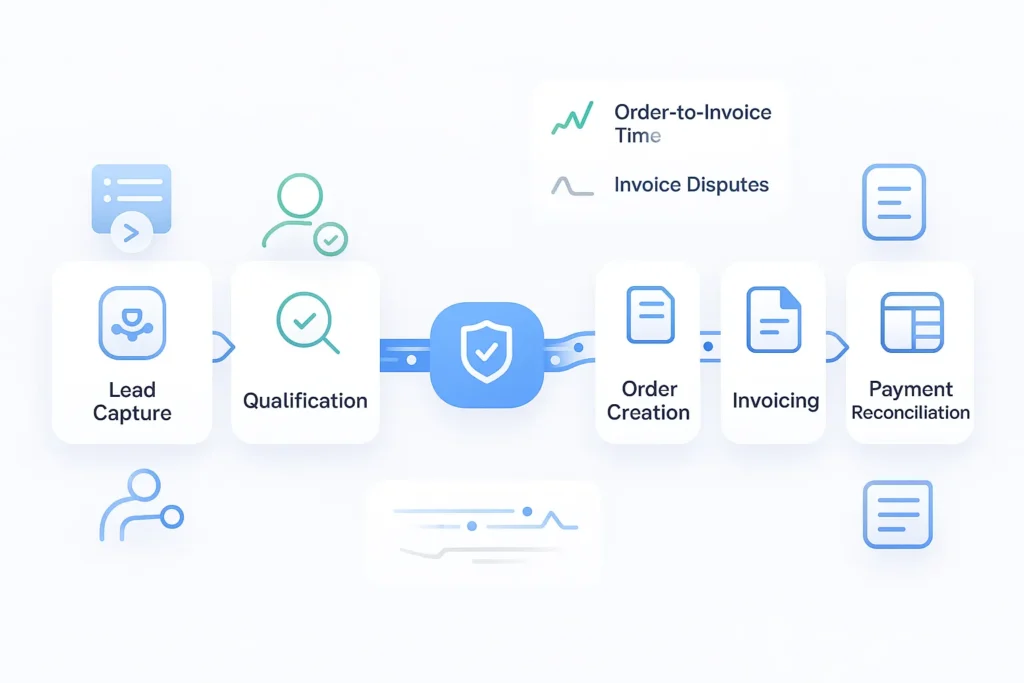

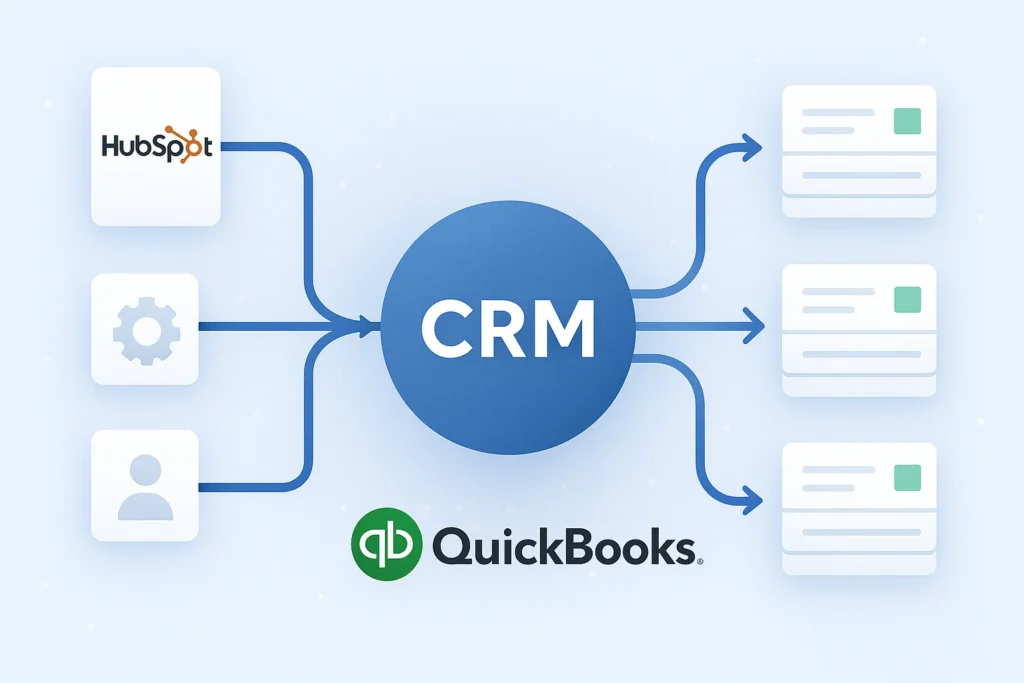

HubSpot NetSuite lead to cash integration delivered a single connected pipeline from marketing lead to revenue recognition. A fast-growing B2B software vendor used HubSpot for marketing and CRM while NetSuite handled order management and accounting. Manual handoffs, duplicate records, and delayed order fulfillment created friction across sales, finance, and customer success. Nidish LLC implemented a HubSpot NetSuite lead to cash solution that automated lead enrichment, opportunity progression, quote-to-order handoffs, invoicing, and payment reconciliation.

Table of Contents

Client background

The client is a mid-market SaaS company with approximately 150 employees and distinct Sales, Finance, and Customer Success teams. HubSpot managed lead capture, lead scoring, and the sales pipeline. NetSuite handled product catalogs, orders, billing, accounts receivable, and revenue recognition. The product mix included recurring subscriptions, one-time services, and usage charges, which required accurate synchronization between HubSpot and NetSuite for an effective lead to cash process.

Challenges (problem statement)

Primary pain points included duplicate customer records, non-deterministic mapping between HubSpot and NetSuite, manual quote to order handoffs that delayed billing, and limited visibility into invoice and payment status in HubSpot. Finance spent significant time reconciling records, which introduced delays to month-end close and increased risk in revenue recognition. The absence of an automated HubSpot NetSuite lead to cash process resulted in invoice disputes and longer days sales outstanding.

Our approach

We adopted a phased, risk-managed approach. Discovery workshops aligned Sales, Finance, and Customer Success on events, data models, and SLAs. We defined a canonical data model and established deterministic external IDs to map HubSpot contacts, companies, and deals to NetSuite customers and orders. The integration design used event-driven synchronization for critical events and scheduled jobs for reference data. We piloted the HubSpot NetSuite lead to cash flow with a subset of SKUs and sales reps, validated reconciliation results, then scaled across product lines.

Solution (what we built)

We delivered a middleware platform with these components:

- Event capture from HubSpot using webhooks for key events such as contact create, deal stage change, quote accepted, and payment received.

- Transformation and enrichment layer that normalized payloads to the canonical schema and applied pricing rules, discounts, and approval checks.

- NetSuite adapters using RESTlets and SuiteTalk to create or update customers, sales orders, subscriptions, and invoices.

- Reverse synchronization to push order confirmations, invoice issuance, and payment receipts back into HubSpot so deals and contacts reflected billing information.

- Monitoring, retry, and reconciliation dashboard for exceptions, reconciliation mismatches, and audit trails.

Security and compliance were enforced using OAuth 2.0, TLS, field-level encryption for PII, and role-based access controls.

Implementation highlights (technical and operational)

Key engineering and operational practices included deterministic linking between systems, nightly and on-demand product and pricebook synchronization, idempotent transaction design to avoid duplicates, exponential backoff for transient failures, and human exception queues for permanent errors. Audit logs captured transactional history for revenue recognition and SOX readiness. Performance testing validated processing SLAs so the majority of accepted quotes were processed within minutes. Change management included training for Sales and Finance and a runbook for failover and rollback.

Results – Before vs After

Before

- Manual order entry for approximately 65% of deals.

- Average order-to-invoice time of 7 days.

- Median time sales spent on data cleanup per deal: 12 minutes.

- Frequent invoice disputes, average dispute resolution time 5 business days.

- Limited visibility in HubSpot into billing and payment status.

After 90 days

- 95% of accepted quotes auto-created in NetSuite.

- Order-to-invoice time reduced by 55% to 3 days.

- Manual data entry effort reduced by approximately 90%.

- Invoice disputes reduced by 60%, resolution time down to 2 business days.

- DSO improved by 8 days.

- HubSpot now displays invoice and payment status, enabling better renewal and upsell conversations.

The HubSpot NetSuite lead to cash integration improved reconciliation accuracy and shortened the month-end close cycle.

Conclusion and next steps

Implementing a HubSpot NetSuite lead to cash integration produced measurable operational and financial benefits including faster billing, fewer errors, improved cash flow, and a single source of truth across sales and finance. Recommended next steps include payment gateway reconciliation, subscription lifecycle automation for renewals and amendments, and predictive AR alerts surfaced within HubSpot.

Contact Nidish LLC to plan a HubSpot NetSuite lead to cash discovery and a 30-day pilot that demonstrates impact in your environment

Blog

Blog Case Studies

Case Studies Career

Career